Uncovering Ashneer Grover Net Worth: From Startup Pioneer to Wealth Icon

Ashneer Grover net worth draws massive attention from entrepreneurs and business enthusiasts. His journey from co-founding BharatPe to bold investments showcases sharp acumen. In 2026, Ashneer Grover net worth in rupees stands around ₹900 crore, or over $108 million. This figure stems from fintech success, equity stakes, and media influence.

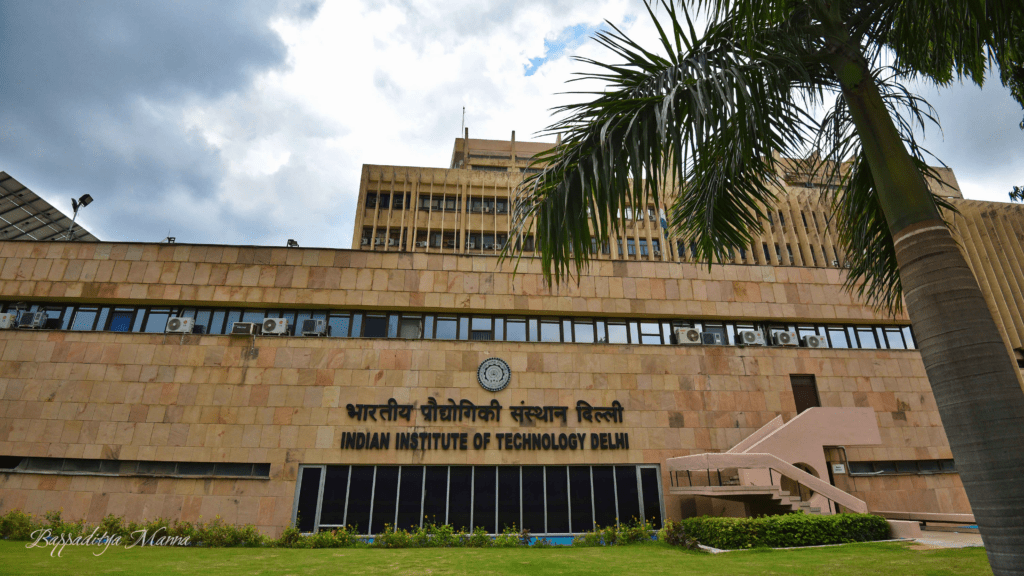

People often search for Ashneer Grover net worth to understand his rapid rise. Born in Delhi, he built a solid foundation with degrees from IIT Delhi and IIM Ahmedabad. These equipped him for roles in banking and startups, leading to his empire.

His story inspires many. From corporate jobs to unicorn status, Ashneer embodies fearless entrepreneurship. Ashneer Grover net worth in rupees reflects not just money, but strategic decisions in India’s booming startup scene.

Early Life and Education Shaping His Path

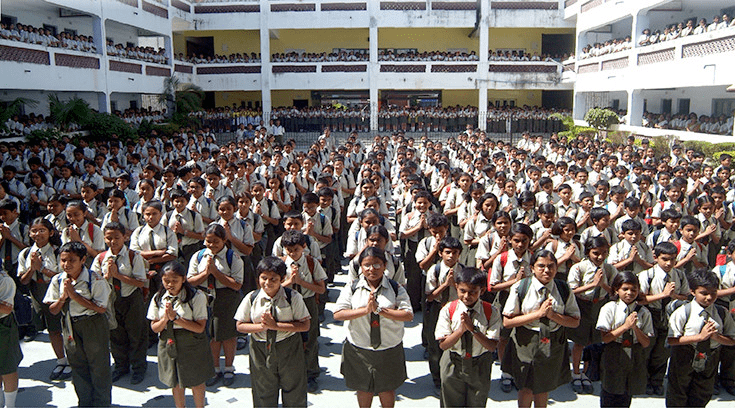

Ashneer Grover grew up in Delhi with a keen interest in academics and business. He pursued civil engineering at IIT Delhi, graduating in 2002 with top honors. This technical base honed his analytical skills.

He then earned an MBA from IIM Ahmedabad in 2006. The program sharpened his management expertise. These institutions provided networks and knowledge crucial for his later ventures.

Education played a pivotal role. It opened doors to finance and tech, setting the stage for his wealth-building journey.

Academic Achievements at IIT and IIM

At IIT, he ranked second in his department. This excellence continued at IIM, where he focused on strategy and finance.

Influence on Career Choices

His degrees led to high-profile jobs. They instilled discipline and vision, key to growing Ashneer Grover net worth.

Entry into the Corporate World

Ashneer started at Kotak Investment Banking as a vice president. He handled mergers and acquisitions, gaining insights into deals.

This role built his financial expertise. He learned to spot opportunities, a skill that later boosted his investments.

From there, he moved to American Express in 2013 as director of corporate development. He drove growth in India, expanding his fintech knowledge.

Key Roles at Kotak and American Express

At Kotak, he managed major transactions. American Express honed his leadership in payments.

Building Financial Acumen

These positions taught market dynamics. They prepared him for entrepreneurial leaps.

Transition to Startups

Experience in banking fueled his shift. He saw gaps in digital payments, leading to his own companies.

Founding BharatPe and Rapid Growth

In 2018, Ashneer co-founded BharatPe, a fintech firm offering QR-based payments for merchants. It simplified transactions for small businesses.

Under his leadership, it expanded to lending and other services. BharatPe became a unicorn in 2021, valued at $2.85 billion.

This success skyrocketed Ashneer Grover net worth. His stake and vision turned it into a market leader.

Innovative Features of BharatPe

QR codes eased merchant payments. Zero fees attracted users quickly.

Achieving Unicorn Status

Rapid funding rounds propelled growth. Investments from top VCs validated his model.

Other Ventures and Investments

Beyond BharatPe, Ashneer launched Third Unicorn in 2023. It focuses on nurturing startups.

He invested in diverse sectors. From fintech like Credgenics to food brands like TagZ Foods.

These moves diversified his portfolio. Ashneer Grover net worth in rupees grew through smart equity plays.

Launch of CrickPe and ZeroPe

In 2023, CrickPe blended fantasy sports with cricket. ZeroPe offers commission-free financial services.

Diverse Investment Portfolio

His picks include logistics like Zippee and energy like Matrix Gas.

Recent 2026 Investments

He backed Lorien Finance in fintech and BluSmart in electric mobility.

Shark Tank India Fame and Impact

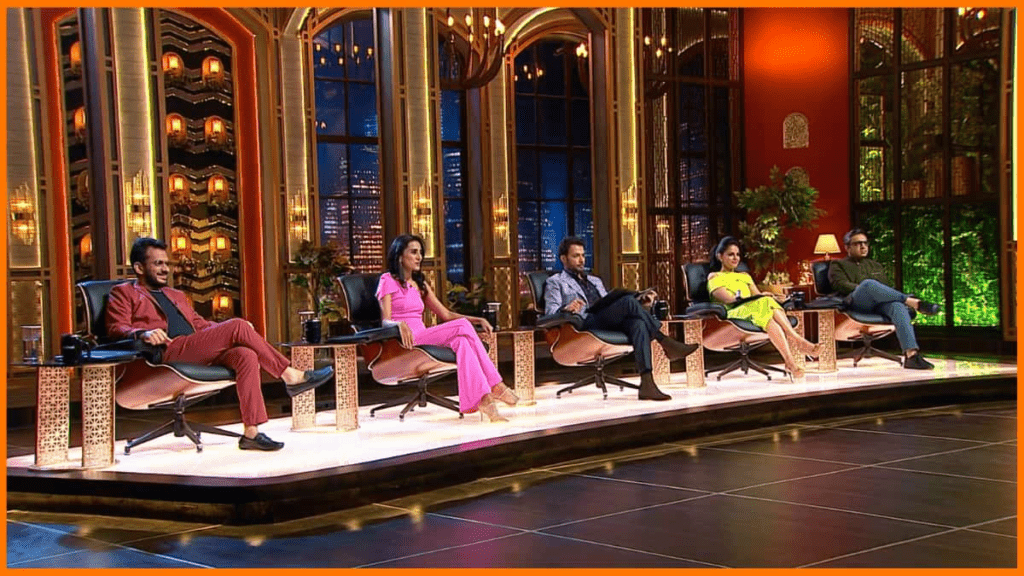

Ashneer joined Shark Tank India as a judge in season one. His candid style made waves.

He invested in innovative pitches, boosting startups. This exposure enhanced his influence.

The show added to Ashneer Grover net worth through visibility and deals.

Memorable Moments on the Show

Bold critiques and investments stood out. He backed unique ideas others skipped.

Boost to Public Profile

Media coverage surged. Social media following grew, opening new opportunities.

Have you followed his Shark Tank deals?

Autobiography and Media Presence

In 2022, he released “Doglapan,” sharing startup truths. It became a bestseller.

Plans for “Doglapan 2.0” and a movie adaptation keep buzz alive.

These ventures contribute to his earnings beyond business.

Insights from Doglapan

The book reveals his unfiltered views on entrepreneurship.

Upcoming Projects in 2026

Movie development and new books expand his brand.

Lifestyle and Personal Life

Ashneer lives in Delhi with wife Madhuri Jain Grover and two children. They maintain a balanced family life.

His lifestyle reflects success. Luxury cars and homes, yet grounded.

Philanthropy interests him, alongside sports enthusiasm.

Family and Personal Interests

Married since 2007, family remains central. He enjoys cricket and fitness.

Philanthropic Efforts

He supports education and startups through mentorship.

Investments and Ventures

Here’s a snapshot of his major moves.

| Venture/Investment | Sector | Year | Estimated Impact on Net Worth |

| BharatPe | Fintech | 2018 | Major stake, unicorn valuation |

| Third Unicorn | Startup Incubation | 2023 | Diversification boost |

| CrickPe | Fantasy Sports | 2023 | Emerging revenue stream |

| ZeroPe | Financial Services | 2023 | Commission-free innovation |

| BluSmart | Electric Mobility | 2025 | Sustainable growth potential |

| TagZ Foods | Snacks | 2022 | Consumer brand expansion |

Lessons from Ashneer Grover’s Journey

Ashneer Grover’s path offers practical insights for budding entrepreneurs. His education from IIT and IIM laid a strong base, but real growth came from spotting market gaps.

He emphasizes resilience. Facing challenges at BharatPe, he adapted quickly, turning setbacks into opportunities.

Strategic thinking stands out. Diversifying investments across sectors like fintech and food minimized risks.

Importance of Education and Networking

Top institutions provided knowledge and connections. These fueled early deals and partnerships.

Embracing Calculated Risks

Bold moves like founding startups paid off. He weighs potential before diving in.

Investment Strategies Driving Wealth

Ashneer Grover net worth stems from smart portfolio choices. He spreads across industries, from logistics to social media.

Research guides his picks. He studies trends, backing innovative ideas with growth potential.

Patience plays a role. Long-term holds in companies like Koo App yielded high returns.

Diversification Across Sectors

Investments in energy, health, and consumer goods balance his assets.

Identifying High-Potential Startups

He spots disruptors early. Factors like team strength and market fit influence decisions.

Tips for New Investors

Start small, learn from failures, and network widely.

Impact on India’s Startup Ecosystem

Ashneer influences beyond his ventures. Through Shark Tank, he mentored countless founders.

His book Doglapan shares raw truths, guiding new entrepreneurs.

In 2026, initiatives like Third Unicorn nurture unicorns, boosting the ecosystem.

Mentorship and Public Speaking

He speaks at events, sharing strategies that grew Ashneer Grover net worth in rupees.

Fostering Innovation

Support for platforms like Freadom promotes education tech.

What drives your entrepreneurial dreams?

Controversies and Comebacks

Ashneer faced public clashes, like on Rise and Fall in 2025. A contestant walked off after heated exchange.

His BharatPe exit in 2022 stirred debates. Yet, he rebounded with new ventures.

These moments highlight his unfiltered style. They add to his relatable persona.

Handling Public Scrutiny

He addresses issues head-on, maintaining transparency.

Lessons from Setbacks

Adaptability turned controversies into learning points.

Future Plans and Projections

In 2026, Ashneer eyes expansions. CrickPe and ZeroPe aim for global reach.

Movie adaptation of Doglapan could boost media earnings.

Ashneer Grover net worth in rupees may climb higher with these.

Expanding New Ventures

Focus on sustainable tech and sports entertainment.

Potential Collaborations

Partnerships in EV and fintech loom large.

Personal Philosophy and Motivation

Ashneer values straightforwardness. His “doglapan” approach means calling out hypocrisy.

Family motivates him. Balancing work with personal life keeps him grounded.

Philanthropy grows. He supports education for underprivileged youth.

Core Values in Business

Integrity and innovation define his style.

Balancing Work and Life

Time with family recharges his drive.

Ashneer Grover’s Influence in 2026

His net worth reflects impact. From banking to billions, he inspires India’s youth.

Media buzz continues. Rumors of Bigg Boss appearance keep him trending.

Ashneer Grover net worth symbolizes smart hustle in fintech.

Cultural Impact

Books and shows shape startup narratives.

Inspiring the Next Generation

Young founders emulate his bold tactics.